Why are the Davos elite worried about the world economy – Bloomberg

Some global investors, Nobel prize winners and academics that participated in the annual meeting of the world economic forum in Davos, believe that things in the world economy is doing very well.

About it writes Bloomberg.

The rapid growth of the world economy since the beginning of the decade, as well as extensive projections return to shareholders provide ideal conditions for many investors. Optimistic buyers of stocks hit eight-year high. Shares worldwide have been estimated at approximately 3.4 trillion US dollars in 2018 revenues continue to grow. Bitcoin going up and down.

See also:

In 2017 the shares of Ukrainian companies were the most profitable in the world – Bloomberg

“Historically, the stock market stock trying to influence the mood of the meeting in Davos,” – said Vice-President I a BlackRock Philipp Hildebrand, who will be one among the three thousand visitors of an Alpine ski resort. – If all will be as it is now, I think, the mood will be good.”

Big dynamics

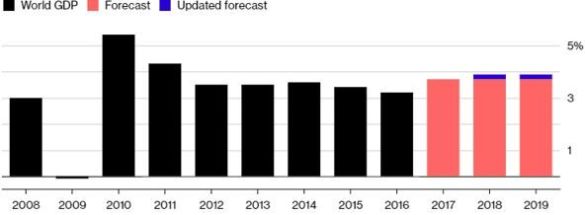

The IMF believes that global economic growth will reach its highest level in seven years.

· Global GDP Forecast Current forecast

The growth of the economy (IMF)

Source: IMF

The question is, can things remain as they are? Not everyone in Davos, sure can.

“Right now we’re happy,” said Robert Shiller, Nobel laureate from Yale University, whose research covers the rise and fall of asset prices. He argues that there are potential Parallels between the present and 1929, when the purchase and sale of shares caused the Great depression.

Some adjustment will “probably not as significant as in 1929, but it could undermine the economy,” Schiller said in an interview.

More optimistic is the Harvard University Professor Kenneth Rogoff, who argues that “the long shadow of the financial crisis” fades, so “economic growth will continue to exceed all metrics”.

China

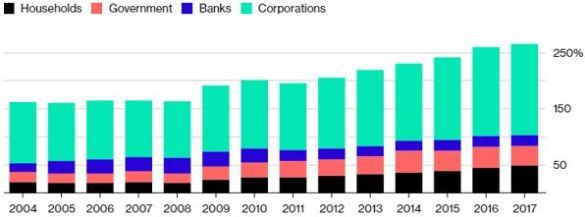

The second largest economy in the world was surprised by the growth in 2017, but is already showing new signs of a slowdown. The plan to reduce risk in the financial system has slowed the growth of credit, but debt in the country, equivalent to about 264% of gross domestic product in 2017, remains a challenge.

As the Chinese government will reduce the amount of the loan, without reducing the rate of growth of the economy, will be one of the biggest challenges of the year. “I think that China will probably be in the midst of, if we’re in a global recession,” said Rogoff.

The debt of China to GDP sectoral:

The Population Government Banks Corporation

The Debt Of China

World debt

It’s not only China. According to the Institute of international Finance, world debt in the third quarter of 2017 rose to a record 233 trillion dollars, which is $ 16 trillion more than at the end of 2016. Private non-financial sector debt reached the highest in Canada, France, Hong Kong, South Korea, Switzerland and Turkey.

See also:

The Minister of economy of Spain called the price attempts of Catalonia to become independent

As interest rates begin to rise, borrowers may start to worry, even if the debt to GDP ratio will decrease, when growth will accelerate.

Interest rates

Rogoff said that “the biggest problem” in the financial markets is the sudden reversal of the trend for lowering inflation through loans.

Protectionism

Margarita Drunik the Hanouz, member of the Executive Committee of the world economic forum, noted that “there is still a danger that the multilateral trading system can break down, as we know, there are many risks on the horizon.”

The problem of trafficking who are unable to be resolved last year, left for 2018. President Donald trump has threatened to break the North American trade agreement and the Pact with South Korea. Also, the United States conducted an investigation regarding allegations of China stealing American know-how. Trump warns that he might introduce new tariffs on imports of Chinese goods, especially of steel.

World politics

North Korea Kim Jong UN threatens the use of military force and nuclear weapons. The uncertainty observed in most parts of the Middle East, when the rising tensions between the US and Iran. Syria remains a powder keg. Concerning Europe, still has not formed a new government in Germany, and the world the prospect of British hand behind Brickset.

See also:

Ukraine or Moldova: who will take the place of the poorest countries of Europe in 2018?

“If you could isolate the economy from politics, you would optimistically tuned in to what’s going on, but, unfortunately, you will never be able to isolate Economics from politics,” said Nobel laureate Christopher Pissarides, who teaches at the London school of Economics.

Trump

Donald trump debuts in Davos this year, a few days after the comments were aimed at African countries and the United Kingdom. He still plans to restrict the entry of tourists predominantly Muslim countries to build a wall along the border of Mexico and apply an aggressive approach to North Korea.

“The most significant political risk is the United States, said Nobel laureate Joseph Stiglitz of Columbia University. – Uncertainty is bad for the world economy”.

Saw a bug — Ctrl+Enter

Letter to the editor

© Materials

Bloomberg.com

Leave your comment

Leave your comment

All comments

Always

deployed

Editor’s choice