The state became a monopoly in the banking market. Results and forecasts 2016-2017

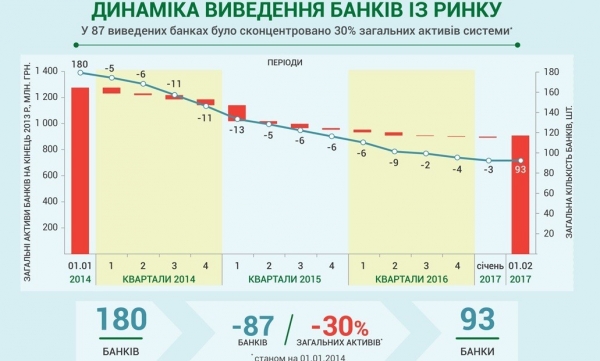

For total Stripping on the Ukrainian market remained to work 93 the Bank. Three years ago there were twice – 180. And after the nationalization of “PrivatBank” , the government became a monopolist in the Ukrainian banking market.

“After the transition “PrivatBank” in state property a share of state banks in the net assets increased to 51.3% (from 28.1% in early 2016), on deposits of the population – almost three times, to 59.5%, “- stated in the national Bank.

The regulator assures that the mass and loud “lopane” banks will be gone.

“Last year was a turning point for the banking sector is gradually coming to an end, the clearing banks, in December 2016 in the capital of PJSC CB “PrivatBank” entered the state. Almost all the banks fully complied with the plans of capitalization, developed on the results of diagnostic tests, most have fulfilled a three-year plan ahead of schedule. The expected reduction in interest rates on deposits of state banks reduce the cost of Bank funding, transfers to reserves are also significantly reduced – so the sector can be profitable (without considering the factor of “PrivatBank”)”, – stated in the report of the NBU.

For 2016, the Bank deposits increased by 117,6 billion UAH equivalent is mainly due to the inflow of funds of business entities. In the structure of banks ‘ liabilities are dominated by internal resources, the share of the population and business in banks liabilities for the year increased from 64% to 73,4%.

The national Bank notes that by returning to the banks clients ‘ funds and lower interest rates during the year from 22% to 14% was created the preconditions for reducing interest rates on deposits.

“Interest rates on 12-month deposits of individuals decreased by 3.8% to 17,5% annual in UAH and 2.2% to 5.7% per annum in U.S. dollars. The cost of deposits in dollars and the Euro reached historic lows as demand of banks on foreign currency funding remains low. The lower cost of funding has created for the banks the opportunity in the second half to cut interest rates on loans, higher rate than the depreciated deposits of the population”, – explained in the national Bank.

At the same time “in 2016, recorded historically high losses of the banking sector – UAH 159 billion, due to the redundancy of the credit portfolio of PrivatBank at the end of the year. For other banks deductions to reserves decreased significantly and the total loss was reduced to 23 billion, compared to UAH 66 bn in 2015. The prerequisites for entering the sector in profitable activities in 2017 (excluding the factor of “PrivatBank”). For 2017 will last for a “reboot” of the banking sector. NBU expects acceleration of growth rates of deposits compared with the year 2016″.

The regulator hopes to resume active lending to the real sector and households and assures that the banks are optimistic. According to the survey of the NBU, more than 70% of financial institutions expect the growth of portfolio companies during the year.

“Addressing the solvency of “PrivatBank”, which offered high interest on deposits, provided the preconditions for a substantial reduction in Deposit rates and reduce the cost of loans for 2017,” – said the NBU.

Read more about the banking sector of Ukraine can be found in the special project of the national Bank.

The national Bank of Ukraine

The national Bank of Ukraine

The national Bank of Ukraine