Kolomoisky said the talks on debt restructuring of “PrivatBank”

The former shareholders of the “PrivatBank” participate in negotiations on loan restructuring.

This TSN.ia said one of the former owners “PrivatBank” Igor Kolomoisky.

“I can report that the former owners of “PrivatBank”, according to the undertaken obligations, participate in the negotiation process for the restructuring of its loans with a consortium of companies, which received a mandate to represent the interests of the Ministry of Finance and “PrivatBank”, which was agreed with the International monetary Fund”, – said Kolomoisky.

See also:

The national Bank began forcibly to collect debts on loans of the former shareholders of the “PrivatBank”

He noted that this negotiation process began in June of this year, is in normal mode and will continue to be necessary to achieve agreements time.

“In my opinion, information sensation which was lifted by officials of the National Bank of Ukraine on the restructuring of loans of the former shareholders of PrivatBank, is associated with the ignorance of the representatives of the national Bank about the ongoing negotiation process (which they are not related). It is likely that the statements of the NBU, which are cut with these official audited accounts of the Bank and distorting the essence of the audit, caused by the desire to absolve themselves of responsibility for the incompetence and the cost to society adopted by the national Bank decisions on nationalization of “PrivatBank”, – said Igor Kolomoisky.

Videocolonoscopy said that the statements of the national Bank can hurt “PrivatBank”

TSN. 19:30

22 Jun, 20:33

See also:

For the capitalization of “PrivatBank”, the state will borrow money

Earlier, the head of the NBU Valery Gontareva said that the last night before the nationalization of “PrivatBank”, the former management of the Bank brought 16 billion. “We have postaudit “PrivatBank”. The identified problems are not only confirmed, but were even increased. 97% of the corporate portfolio were issued to related parties, and 100%. This means that the need for additional capitalization of more – and the state will have to pay even more money to compensate the losses of the Bank management team of oligarchs,” she said.

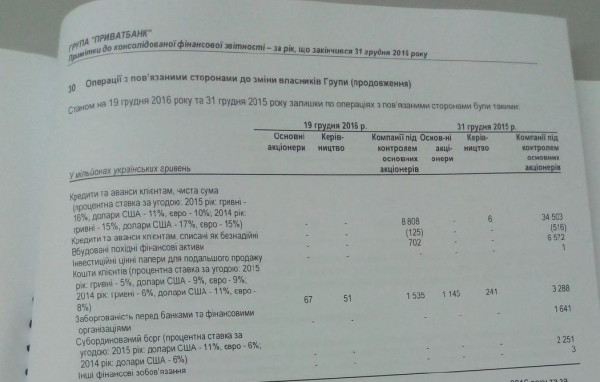

Later in the media was published on the official annual report of “PrivatBank”, which the auditor was Ernst & young, in which they talked about the amount of UAH 8.8 bn. “If state-appointed top managers of “PrivatBank” in his report to the government is counted at the Bank about 9 billion hryvnia loan companies, “associated with the previous shareholders” at the time of nationalization, I have no reason not to trust them. Because these managers were appointed by the National Bank and the Ministry of Finance after careful selection and analysis of their professional skills”, – said Igor Kolomoisky.

It is worth noting that on June 23 this year, the government adopted a decision on additional capitalization of the Bank government 38.5 billion. It is noted that this process will occur in two phases by the issue of bonds of domestic Treasury bonds in exchange for Bank shares. Prior to this decision the government has already issued bonds of domestic Treasury bonds in 117 billion.